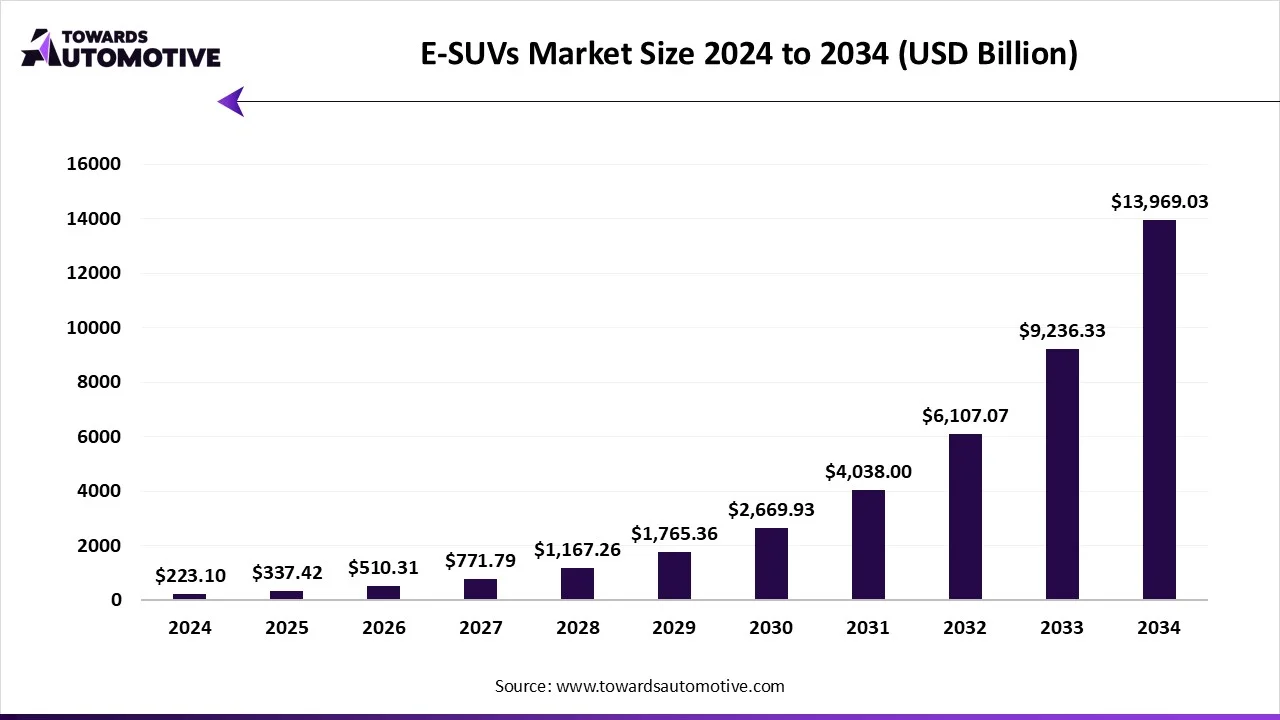

E-SUVs Market Size Expected to Propel USD 13,969.03 Bn by 2034 | Towards Automotive Analysis

According to Towards Automotive research, the global E-SUVs market size is calculated at USD 337.42 billion in 2025 and is expected to reach around USD 13,969.03 billion by 2034, growing at a CAGR of 51.24% from 2024 to 2034.

/EIN News/ -- Ottawa, April 30, 2025 (GLOBE NEWSWIRE) -- The global E-SUVs market size was valued at USD 223.10 billion in 2024 and is predicted to hit around USD 13,969.03 billion by 2034, a study published by Towards Automotive a sister firm of Precedence Research.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardsautomotive.com/download-brochure/1716

Market Overview:

The E-SUVs market is experiencing significant growth as more consumers lean toward electric vehicles that provide sustainability while maintaining performance and comfort. E-SUVs merge the spaciousness, versatility, and rugged charm of conventional SUVs with the eco-friendly and cost-effective benefits of electric powertrains. Enhanced battery capacity, fast-charging networks, and advancements in driving range are making E-SUVs more viable for everyday commuting and long-distance journeys.

Recent Product Innovations by Top Market Companies

| Sr. No. | Name of the Company | Name of the Model | Name of the Brand | Usage |

| 1. |

Tesla, Inc. |

Tesla Model X | Tesla | Electric SUV |

| Tesla Model Y | Tesla | Electric Compact SUV | ||

| 2. |

Ford Motor Company |

Ford Mustang Mach-E | Ford | Electric SUV |

| Ford F-150 Lightning | Ford | Electric Pickup SUV | ||

| 3. |

Volkswagen AG |

Volkswagen ID.4 |

Volkswagen |

Electric Compact SUV |

| Volkswagen ID. Buzz |

Volkswagen |

Electric Minivan |

Automakers are heavily investing in a variety of E-SUV models to meet different price points and customer preferences, ranging from compact urban SUVs to high-end luxury variants. Rising awareness of environmental concerns, supportive government initiatives promoting electric transportation, and appealing incentives are further driving the global uptake of E-SUVs. As the automotive sector continues to shift toward electrification, E-SUVs are emerging as a vital segment, delivering an ideal solution that balances sustainability, performance, and the classic desirability of SUVs.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Major Trends in the E-SUVs Market:

- Development of Fast-Charging Networks: The establishment of comprehensive fast-charging infrastructure throughout highways and cities is promoting long-distance travel in E-SUVs, enhancing consumer confidence and facilitating broader acceptance of electric SUVs worldwide.

- Adoption of Advanced Technologies: E-SUVs are progressively integrating autonomous driving capabilities, AI-driven energy management systems, connected vehicle features, and improved infotainment options, providing consumers with premium driving experience.

-

Introduction of Budget-Friendly E-SUV Models: Manufacturers are launching more budget-friendly E-SUV options to appeal to a wider audience, making electric SUVs a viable option.

Limitations & Challenges in E-SUVs Market:

- Elevated Initial Purchase Costs: Even with available incentives, the higher initial costs associated with E-SUVs compared to traditional internal combustion engine SUVs remain an obstacle for many budget-conscious consumers, limiting broader market adoption in select areas.

- Concerns Over Limited Driving Range: Despite enhancements in battery technology, consumers still experience range anxiety, particularly in rural or underserved regions with fewer charging stations, which hampers the broader acceptance of E-SUVs.

-

Unreliable Charging Infrastructure: While urban centers typically feature robust charging facilities, the absence of a consistent and accessible charging network in rural or suburban areas poses a serious challenge to the widespread use of E-SUVs.

Future Opportunity in the E-SUVs Market

The greatest opportunity for the E-SUVs market stems from the ongoing global shift toward sustainable transportation. As governments worldwide tighten emissions regulations and provide increased incentives for electric vehicle adoption, the demand for E-SUVs is set to experience substantial growth.

Improvements in battery efficiency, coupled with expanding fast-charging infrastructure, will make E-SUVs more practical for consumers. Additionally, automakers are putting greater emphasis on creating affordable E-SUV models to appeal to a broader consumer base, generating considerable prospects in both emerging and established regions. Moreover, advancements in automotive technology create immense opportunities in the market.

- In November 2023, Lucid Motors introduced the groundbreaking Lucid Gravity, a luxury electric SUV. The Gravity SUV is engineered to be a high-performance model with a projected driving range exceeding 440 miles and capacity for up to seven adults along with their belongings.

Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership

Regional Analysis:

Asia Pacific: Leader in the E-SUVs Market

Asia Pacific dominated the market with the largest share in 2024, driven by government policies promoting electric vehicle adoption, substantial consumer interest, and major investments from both local and global automakers. Nations such as China, Japan, and South Korea are actively encouraging electric mobility through subsidies, tax benefits, and development of charging infrastructure.

Top Asia Pacific Countries for E-SUVs Production

- China: China is at the forefront of E-SUVs production. Government incentives, expanding EV charging network, and ambitious targets to eliminate internal combustion engines, making it the largest E-SUV market worldwide.

- Japan: With its emphasis on clean energy vehicles and investment in battery technology, Japan has increased its E-SUVs production in the last few years. Major automotive manufacturers in the country are continually innovating and launching new electric SUV models, supporting market growth.

-

South Korea: South Korea’s dedication to green mobility, support for electric vehicle manufacturing, and growth in ultra-fast charging stations have established it as a noteworthy market for E-SUVs.

The area also enjoys a densely populated urban environment that enhances the practicality of E-SUVs for daily commuting. Increasing environmental concerns and government measures aimed at reducing vehicle emissions have further hastened the transition toward electric SUVs. In addition, domestic manufacturers are focusing on developing new models to meet consumers’ demands, solidifying the region’s position in the market.

- In March 2025, BYD revealed the Fangchengbao Tai 3, its inaugural battery electric SUV under the Fangchengbao brand. The Tai 3 provides an impressive range of up to 501 km (CLTC) and incorporates BYD’s Blade LFP battery technology. An exceptional variant features a roof-mounted drone system developed in collaboration with DJI, highlighting BYD’s innovative approach in the Asia Pacific E-SUV sector.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and drive better outcomes—schedule a call today: https://www.towardsautomotive.com/schedule-meeting

North America’s Significant growth in the E-SUVs Market

North America is expected to witness significant growth during the forecast period, driven by rising consumer interest in sustainable vehicles and increasing investments by major automakers in electric mobility. The region benefits from favorable government programs, including tax rebates and funding for EV charging infrastructure. A rise in environmental consciousness, coupled with advancements in battery technology that enhance driving ranges, has further fueled adoption.

Major Factors for the Market’s Expansion in North America:

- Federal and state-level incentives, tax credits, and grants for purchasing electric vehicles are significantly enhancing the adoption of E-SUVs across the United States and Canada.

- Significant investments in creating extensive, fast, and ultra-fast EV charging networks are alleviating range anxiety, making E-SUV ownership more convenient and appealing across North America.

- The prevailing cultural preference for spacious and versatile SUVs aligns seamlessly with the shift toward electric mobility, pushing the demand for electric SUVs in North American markets.

Segment Outlook

Propulsion Insights

The HEV segment dominated the E-SUVs market with the largest share in 2024. This is mainly due to increased consumers' desire for a harmonious blend of fuel efficiency and reduced emissions without entirely depending on charging infrastructure. Hybrid electric vehicles (HEVs) provide flexibility for long journeys and benefits from established refueling networks. This appeal is particularly pronounced among buyers in emerging markets where comprehensive electric charging infrastructure is still being developed, thus driving HEV demand within the E-SUV sector.

The BEV segment is projected to expand at a significant CAGR during the forecast period, driven by strict emission regulations, improvements in battery technology, and the growth of charging infrastructure. Governments around the globe are actively promoting battery electric vehicles (BEVs) adoption via incentives and policy initiatives. Automakers are increasingly introducing a wider array of high-performance BEV E-SUVs, which offer enhanced range and quicker charging options. Heightened consumer awareness regarding environmental sustainability further accelerates the adoption of BEV models.

Size Insights

The mid-size segment led the E-SUVs market in 2024. Mid-size E-SUVs offer a balance between cost, performance, and practicality. Mid-size E-SUVs attract urban and suburban families due to their roomy interiors, impressive driving range, and lower operational expenses when compared to larger vehicles. Numerous automakers are concentrating on this segment to reach a broader consumer audience seeking versatile and reasonably priced electric SUVs.

The full-size segment is likely to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to the increasing consumer interest in luxury, performance, and greater driving range. Full-size models boast advanced features, exceptional comfort, and increased cargo space, making them suitable for long trips and premium customers. Luxury brands are heavily investing in the development of full-size electric SUVs that provide longer battery life, innovative technology, and elegant designs, driving the segment’s growth.

Driving Range Insights

The 150 to 300 km segment dominated the E-SUVs market with the largest share in 2024. This driving range satisfy the everyday commuting and travel requirements of most urban users. This range is deemed optimal for city driving and occasional intercity trips while remaining budget friendly. Automakers are strategically producing models that fit within this range to target cost-conscious consumers who desire dependable electric mobility solutions without forgoing performance or convenience.

The above 300 km segment is expected to expand at the fastest rate during the projection period, driven by advancements in battery technology and vehicle efficiency. Since range anxiety remains a significant concern for potential EV buyers, manufacturers are emphasizing longer-range E-SUVs to boost consumer confidence. The increasing availability of high-capacity batteries and rapid-charging infrastructure further supports this expansion. Consumers looking for versatile vehicles suitable for both urban and long-distance travel are progressively choosing E-SUVs that offer more than 300 km of range.

Components Insights

The powertrain segment dominated the market in 2024, as it is essential for optimizing overall performance, efficiency, and durability in electric SUVs. Innovations in electric motors, transmissions, and power control units are critical for improving vehicle acceleration, energy consumption, and driving dynamics. Automakers are significantly investing in cutting-edge powertrain technologies to enhance driving experience and amplify the attractiveness of their E-SUV models.

The battery segment is expected to expand at the highest CAGR in the upcoming period, driven by ongoing advancements in battery energy density, charging speed, and lifespan. As batteries constitute a large portion of the E-SUVs’ costs and determine their range and performance, manufacturers are concentrating on next-generation battery technologies such as solid-state batteries. Rising investments in battery production facilities and research initiatives worldwide are propelling rapid advancements, positioning the battery segment as a crucial component for E-SUVs.

Browse More Insights Towards Automotive:

- Automotive Oil Change Market https://www.towardsautomotive.com/insights/automotive-oil-change-service-market-sizing

- Water Tanker Truck Market: https://www.towardsautomotive.com/insights/water-tanker-truck-market-sizing

- Travel Trailer Market: https://www.towardsautomotive.com/insights/travel-trailer-market-sizing

- Vehicle Intrusion Detection Market: https://www.towardsautomotive.com/insights/vehicle-intrusion-detection-market-sizing

- Automotive Bearing and Clutch Component Aftermarket: https://www.towardsautomotive.com/insights/automotive-bearing-and-clutch-component-aftermarket-sizing

- Automotive Key Blank Market: https://www.towardsautomotive.com/insights/automotive-key-blank-market-sizing

- Anti-aircraft Warfare Market: https://www.towardsautomotive.com/insights/anti-aircraft-warfare-market-sizing

- Surface Protection Service Market: https://www.towardsautomotive.com/insights/surface-protection-service-market-sizing

- Small Marine Engine Market : https://www.towardsautomotive.com/insights/small-marine-engine-market-sizing

- Permanent Magnet Motor Market : https://www.towardsautomotive.com/insights/permanent-magnet-motor-market-sizing

Competitive Landscape

- Tesla Inc.

- BYD Company Ltd.

- Hyundai Motor Company

- Toyota Motor Corporation

- Nissan Motor Corporation

- Kia Corporation

- Ford Motor Company

- Volkswagen AG

- AB Volvo

- Honda Motor Co., Ltd.

- Chevrolet

Recent Breakthroughs in Global E-SUVs Market:

- In June 2024, Chevrolet introduced the Equinox EV, a compact, all-electric SUV. It's designed for mainstream consumers, offering a blend of affordability, attractive design, and a notable 319-mile range.

- In May 2024, Jeep introduced its first fully electric SUV for the North American market: the Wagoneer S and the Recon. The Wagoneer S offers 600 horsepower and a 400-mile range, while the Recon features off-road capabilities similar to those of the Wrangler. Both models are part of Jeep’s initiative to electrify 50% of its U.S. sales by 2030.

Segments Covered in the Report

By Propulsion

- BEV

- HEV

By Size

- Compact

- Mid-Size

- Full- Size

By Driving Range

- Upto 150 km

- 150 to 300 km

- Above 300 km

By Component

- Body

- Chassis

- Powertrain

- ICE

- Motor

- Up to 20 kW

- 20 to 100 kW

- Above 100 kW

- Battery

- Upto 10 kWh

- 10 to 30 KWh

- 30 to 60 kWh

- Above 60 KWh

- Electronics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For pricing details and customized market report options, click here: https://www.towardsautomotive.com/price/1716

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release